Five questions about tax, answered

First Nations Foundation and Melanie Noble

- Money Lessons

-

How much tax does each person need to pay?

The amount of tax each person pays depends on how much they earn over the financial year (July 1- June 30). Some people don’t pay any tax due to lower earnings, while others who earn more pay tens of thousands of dollars in tax each year.

The below table shows the tax rates for Australian residents in the 2022-23 financial year. Keep in mind, these rates change each year. They also don’t take into account the 2 per cent Medicare levy, which is an extra charge for taxpayers who earn over a certain amount.

| Taxable income | Tax on this income |

|---|---|

| 0 – $18,200 | Nil |

| $18,201 – $45,000 | 19 cents for each $1 over $18,200 |

| $45,001 – $120,000 | $5,092 plus 32.5 cents for each $1 over $45,000 |

| $120,001 – $180,000 | $29,467 plus 37 cents for each $1 over $120,000 |

| $180,001 and over | $51,667 plus 45 cents for each $1 over $180,000 |

Source: ATO.

READ MORE: The basics of tax

2. How is tax paid?

If you’re an employee, tax will be taken out of your weekly, fortnightly or monthly earnings by your employer. At the end of the financial year, you can find out how much you’ve paid in tax through the ATO section of your MyGov account.

If you are self-employed, you have to pay your tax yourself at the end of the financial year. Again, you can use MyGov to find out how much you owe after deductions.

Whether you’re an employee or self-employed, a qualified accountant or tax agent can help you to prepare your tax. You also have the option of preparing it yourself.

3. How do you work out what your tax bill or refund will be?

You can receive an estimate of how much tax you will have to pay or receive back (if your deductions are higher than any additional money you owe) when you prepare to lodge your tax through MyGov or a tax agent.

However, you can also get an estimate of how much tax you may have to pay based on your earnings using the ATO’s simple tax calculator.

The calculator doesn’t take into account certain things, like the Medicare levy, Medicare levy surcharge or money owed to the government for study.

4. What deductions can be claimed?

Depending on what your job is, certain things you buy throughout the year are considered exempt from tax if they help you to earn money through your work. As a result, you can claim these items as “deductions” at the end of the financial year. You need receipts to claim any of these items.

Common deductions include:

- Car and travel expenses

- Laundry expenses

- Home office expenses

- The cost of managing your tax

- Gifts or donations to registered charities.

It’s important to remember the work-related tax claims can only be made if the activity was directly related to you earning income. You also cannot claim a deduction if you have been reimbursed or paid back by your employer.

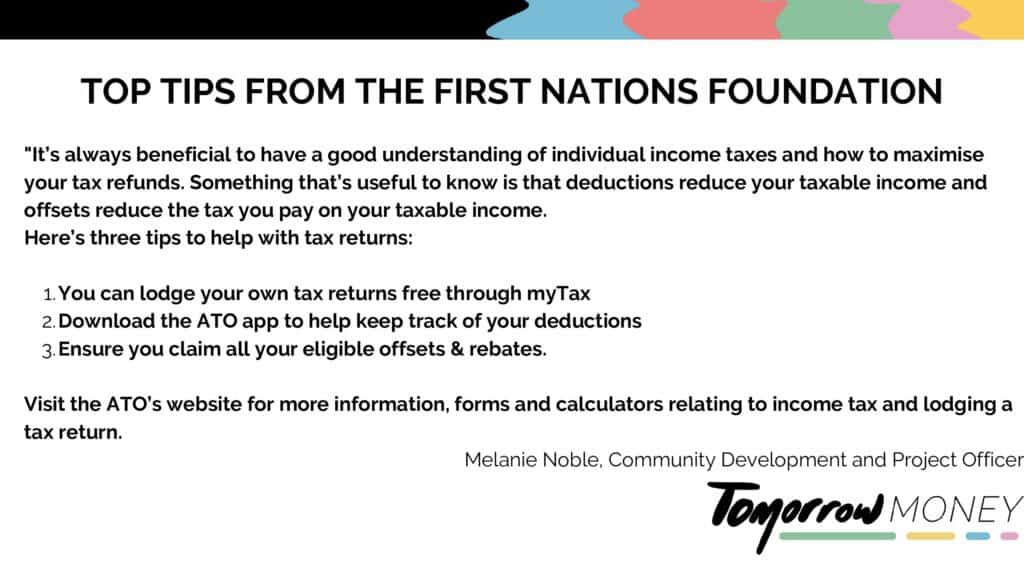

5. Where can I get help?

The good news is there is a lot of support available if you want to learn more about your tax.

Some info lines and websites include:

- Indigenous tax help line: 13 10 30 (staffed 8am-6pm Monday to Friday)

- The Australian Taxation Office

- MoneySmart.

This article does not constitute tax or financial advice.

Let us know if you liked this article

Let us know if you liked this article