The building blocks: Heard these investing terms? Here’s what they mean

Morningstar

- Money Lessons, Womens

The investment world is full of jargon to explain how investing works. However, a better understanding of some of the common concepts used in investing is also helpful in your investment journey. In this article, we explain and demystify some of these concepts.

Revisiting compounding and inflation

We have already explored the important investment concept of compounding in our earlier article Why Invest. As a refresher, it is important to remember that both the combination of time in the market and compounding will help you better manage your financial security.

Equally inflation is another important concept which we highlighted in our most recent article, How inflation impacts investing. It’s important to add that you also have your own inflation rate and that may differ from “official” inflation rates. Let’s explain this further. Governments measure inflation by comparing the price of baskets of goods over time. That is a great way to measure how overall price levels change across the economy but how this applies to individuals varies.

If you are older and own your home outright, you may not care about changes in housing affordability but might be very focused on the costs of medicine and health. The opposite may be true if you are younger and looking to buy your own home as prices rise. As with any part of crafting a financial plan, it is critical to understand the drivers of your own costs and how these are linked with the returns of different investments.

Diversification

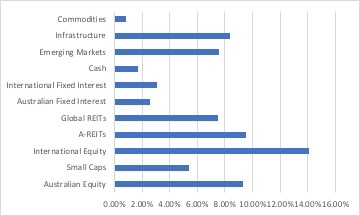

Diversification is another common term used in investing. What it means is, investing in different assets such as stocks and bonds. The goal of building a diversified portfolio is to lower risk without impacting the level of returns. This ensures that these assets are not “correlated” with each other. In other words, the portfolio includes asset classes that are supposed to go up in value when other asset classes go down in value. That way there is less short-term instability in the value of your portfolio. This can be best illustrated in the graph below which shows the different returns of the various asset classes. Here, it is important to note, that sometimes the price of assets can move in the same direction, particularly in the short-term. Recently, the value of stocks and bonds both fell in value.

Ten year return of assets

Source: Morningstar, data as at 30 June 2022

Risk and investing

Risk is also commonly applied in investing. The key question is what is the risk that you are trying to diversify away from?

Risk can be defined as losing money that cannot be made back. For investors, that’s the risk of not having enough money in time to retire or having to change your lifestyle so that your savings last throughout retirement.

Sometimes it’s worth taking some time to think about your own view of risk and how changes in the value of your portfolio would impact your life. For example, if you are investing for the long term, can you cover any short-term costs with an emergency fund? The less value that an investor puts on the correlation of returns of different asset classes, the more attention can be paid to building a quality investment portfolio that is properly diversified.

Morningstar is an independent investment research house. Any general advice has been prepared by Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892), without reference to your objectives, financial situation or needs. Neither Morningstar, its affiliates, nor the content providers guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution. Past performance does not necessarily indicate a financial product’s future performance.

For advice relating to your personal situation, speak to a qualified financial adviser. If you’re having trouble with money, speak to a free financial counsellor via the National Debt Helpline: 1800 007 007.

Let us know if you liked this article

Let us know if you liked this article