The building blocks: How inflation impacts investing

Morningstar

- Money Lessons, Super & Insurance

The article, Why things are getting more expensive, explained why you are paying more at the supermarket because of price rises known as inflation. In this article, we explain how inflation impacts your investments.

Inflation is a critical concept when it comes to investing. No doubt you would have often heard older people remember when they were able to buy a soft drink for just 10 cents when they were young.

While we have a clearer picture of inflation when we look at past prices, few people take this into account when considering future prices. As you may know, inflation is defined an increase in the price of goods and services and a fall in the purchasing value of money.

With this in mind, let’s look at how inflation plays a role when looking at investment returns.

Key concepts

In the investment world, we often, but not always, measure success by the returns that are achieved. In other words, in an absolute sense, how much our money has grown. For example, if at the start of the year we have $10,000 and at the end of the year we have $11,000, then we have achieved an absolute return of 10% in year.

However, as an investor, we need to focus on what’s called the real rate of the return. This is done by understanding the impact from the increase cost of goods and services, that is inflation-adjusted returns.

Let’s look at the example again to explain these concepts further. If at the start of the year we have $10,000 and at the end of the year we have $11,000 but inflation increases 5%, what is our real rate of return or inflation-adjusted return? Our absolute return remains 10% but given the 5% increase in the cost of goods and services, our real rate of return or inflation-adjusted return is only 5%.

The key lesson here is that if returns are the measure of success, investors may be better off focusing on the real rate of return or inflation-adjusted returns.

Why does this matter for investors?

Now that we have described the basics of inflation, we can start to consider why it matters to investors.

Applying inflation to investment returns will give you a more complete picture of the growth of your investment in terms of purchasing power – that is your ability to buy things. This is especially true with so-called “safe” options such as bank savings accounts, as a guaranteed 2% is not very effective in a 3% inflation environment.

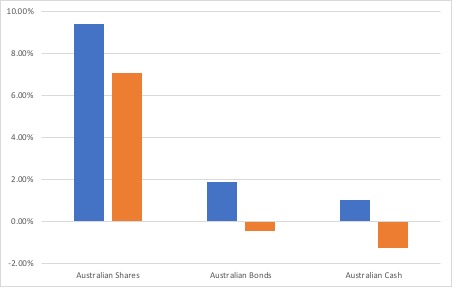

The graph below, best illustrates the impact of inflation on the investment returns of shares, bonds and cash before and after the annual inflation rate over the last five years. The blue bars represent the performance of different types of investments, while the orange bars show the result after inflation is taken into account.

The impact of inflation on investment returns, 2017–2022

Source: Morningstar Investment Management. Data as at the end of March 2022.

Morningstar is an independent investment research house. Any general advice has been prepared by Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892), without reference to your objectives, financial situation or needs. Neither Morningstar, its affiliates, nor the content providers guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution. Past performance does not necessarily indicate a financial product’s future performance.

For advice relating to your personal situation, speak to a qualified financial adviser. If you’re having trouble with money, speak to a free financial counsellor via the National Debt Helpline: 1800 007 007.

Missed an article in the building blocks series? You can catch up here:

Let us know if you liked this article

Let us know if you liked this article