The building blocks: What are stocks and bonds?

Morningstar

- Money Lessons, Womens

In this regular series prepared for Tomorrow Money, research house Morningstar talks about the fundamentals of investing.

In our last article we explored why investing is key to building your long-term wealth. In this article, we explain two major types of assets that you can invest in, shares and bonds.

Companies often need to raise money or what is commonly called in the industry, ‘capital’. This is often because these businesses may want to grow and need these funds to do that. Companies can raise this capital through the banks. There are also two other option – either through equity (shares) or through debt (bonds).

What is a share?

A share is simply an ownership interest in a company. This means you can actually own part of a business by buying a share in the business. Typically, you buy a share once the company lists on public exchanges such as the Australian Securities Exchange (ASX). You can buy shares in both Australian and global companies.

Businesses are created by a person or a small group of people who have also invested or put their money into this business. These businesses are considered “private”. However, often when a business reaches a certain size, the company may decide to “go public” and sell a chunk of itself to the investing public. This is how shares are created. One high profile example was of course Facebook when its co-founder Mark Zuckerberg listed the business back in 2012.

How do shares work?

The fun part is that when you buy a share you also own part of the business. Over the long term, the value of that ownership stake will rise and fall according to the success of the underlying business. The better the business does, the more your ownership stake will be worth.

You may also receive ‘dividends’ when you buy a share. Dividends are simply payments made by the companies to shareholders as a way to share the profit of a business. Some companies pay higher dividends than others.

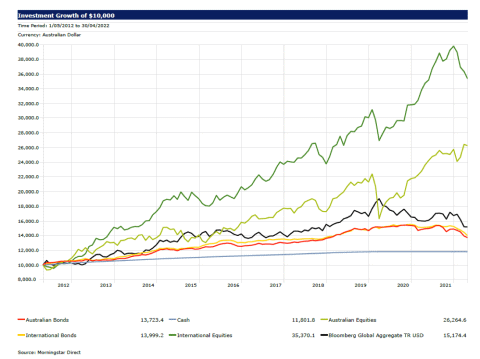

There are of course some downsides. Shares tend to be the most volatile investments, that is their value can move up and down sharply. Bad luck or bad timing can easily sink your returns, but you can minimise this by taking a long-term investing approach. For example, the chart below shows the returns of Australian and international share market over the last 10 years. While there were periods of dips, they both performed strongly.

What is a bond?

When companies or governments want to borrow money, they do this by issuing a bond. By buying a bond, you are giving a loan to that government or business – ‘the issuer”. Think of it as an IOU between the borrow and lender. Just like shares, you can buy bonds from both Australian and global companies.

These bonds are provided to investors based on a fixed term such as three years or even 10 years. There is also an agreement on the interest paid and how long it will take the company to pay it back After that period ends, the bond ‘matures’ and the original money, ‘the principal’ is returned to the investor. During that period, the company or government providing the bond, pays you interest in return for you lending them the money. This provides investors with a relatively stable source of interest payments.

Source: Morningstar

How do bonds work?

The value of a bond is directly related to interest rates. As interest rates go up, the market prices of bonds go down and vice versa. Until a bond matures, its price on the secondary market (where bonds and bought and sold) changes in response to changes in interest rates. If you sell your bond before it matures, the price may be more or less than you originally paid for it, depending on current interest rates.

The other factor affecting the prices of bonds is the “credit quality” of a bond. This measures how safe the bond is. If a bond issuer is at risk for “default”, that is collapse, it receives a low credit rating. A higher credit rating means you have a higher chance of getting your money back! Credit ratings are based on a grading system used by rating agencies, with AAA being the highest possible grade all the way down to a grade of C.

Bonds are more stable than stocks but riskier than term deposits or cash in the bank. They are not great for making your money grow rapidly, but they can help to diversify your portfolio.

Morningstar is an independent investment research house. Any general advice has been prepared by Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892), without reference to your objectives, financial situation or needs. Neither Morningstar, its affiliates, nor the content providers guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution. Past performance does not necessarily indicate a financial product’s future performance.

For advice relating to your personal situation, speak to a professional financial adviser. If you’re having trouble with money, speak to a free financial counsellor via the National Debt Helpline: 1800 007 007.

Let us know if you liked this article

Let us know if you liked this article